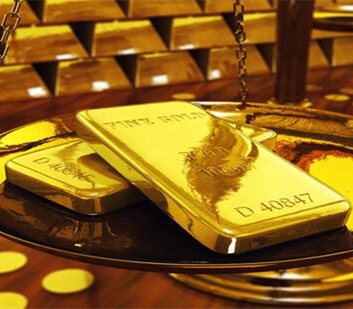

Gold prices hit by profit taking, stronger dollar

time:2016-03-11 10:05:31 Click number:7199

Gold lost some of its touted recent gains Wednesday, as the U.S. dollar index remains strong, enticing even more profit-taking pressure from the shorter-term traders.

Spot gold was last down $8.40 at $1,254.10 an ounce in New York, having hit a three-day low earlier in the session at $1,251.83 an ounce.

Until last week, negative macroeconomic sentiment and a weaker U.S. dollar had prompted the strongest two-month rally in gold since 2011.

The yellow metal has gained 18% in value since the start of the year, boosted by market volatility and geopolitical concerns. Bullion is considered a safe haven and prices rise in times of heightened risk as investors seek a stable asset in which to store their cash.

Expectations that the European Central Bank may loosen its monetary policy further on Thursday weakened the euro against the dollar.

Follow Us in LinkedIn

Follow Us in Youtube

Follow Us in Facebook

Address: No.9 Industrial Avenue of Guzhang Industrial Park, Shicheng County, Ganzhou City, Jiangxi Province, China

Tel:+86-797-5793186 Fax:+86-797-5793558 mobile phone:+86-13870712983

赣公网安备36073502000186

赣公网安备36073502000186